Update from collecting new 69 plate motorhome today.

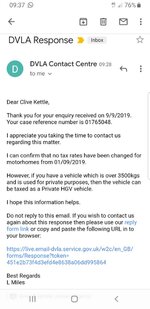

Well it seems my dealer was not guilty of 'gilding the lilly' and was truthful when they advised that my new Euro 6c 3500kg motorhome would be taxed at the existing VED rate (post No. 54 in this thread) and thats what happened when it was taxed with DVLA today.

So, as for the stories being peddled by some dealers at the outset of this thread, I will leave you to make up your own mind!!

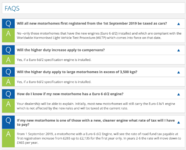

So for the avoidance of doubt, your MH was taxed at the existing PLG rate (as a Euro 6C should be) and not the existing Diesel Car rate?

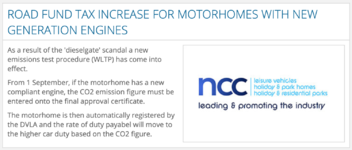

Referring to the "existing" VED rate is confusing, as there is no new tax class