Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Nationwide Travel Insurance Update

- Thread starter PhilandMena

- Start date

We rely on our Nationwide account for travel insurance.

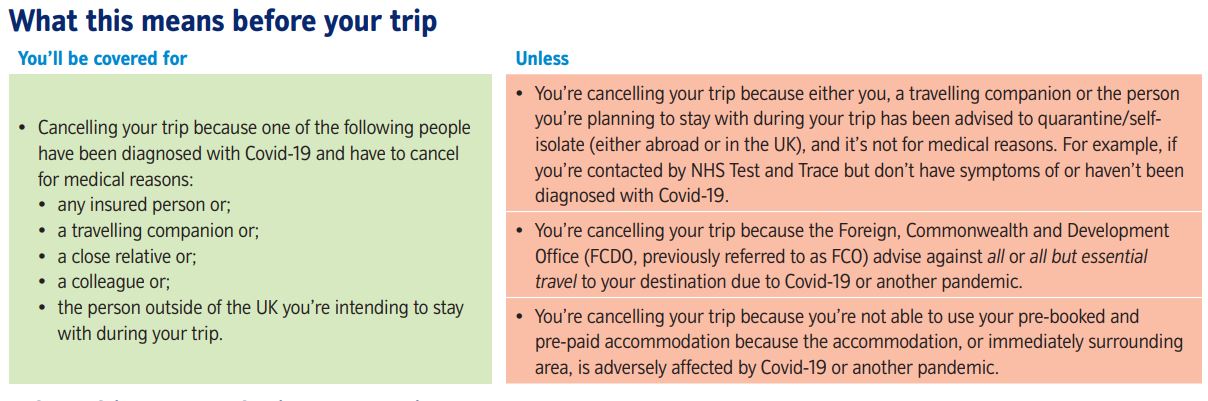

If I have understood it correctly, we would be able to claim if we had to cancel a booking because one of us had the disease but not if we have been told to self isolate by track and trace without having symptoms.

I think that is irresponsible of Nationwide, as it encourages people to disregard T&T and travel anyway.

If I have understood it correctly, we would be able to claim if we had to cancel a booking because one of us had the disease but not if we have been told to self isolate by track and trace without having symptoms.

I think that is irresponsible of Nationwide, as it encourages people to disregard T&T and travel anyway.

- Jun 29, 2015

- 3,842

- 63,716

- Funster No

- 36,999

- MH

- caravan (for now)

- Exp

- on and off since 1984

How would they know if you have symptoms or not from the claim form?

- Dec 24, 2014

- 10,242

- 54,775

- Funster No

- 34,553

- MH

- Compass Navigator

- Exp

- Ever since lighting was by Calor gas.

I think their point is not whether or not you have symptoms but whether you have been 'told' by T&T to self-isolate, which I assume they can ascertain from the T&T records.How would they know if you have symptoms or not from the claim form?

Although I've understood that the T&T info was confidential.

- Jun 29, 2015

- 3,842

- 63,716

- Funster No

- 36,999

- MH

- caravan (for now)

- Exp

- on and off since 1984

Yes but if you have to cancel a trip, and you can only claim if you say you have symptoms how will they knowI think their point is not whether or not you have symptoms but whether you have been 'told' by T&T to self-isolate, which I assume they can ascertain from the T&T records.

Although I've understood that the T&T info was confidential.

Subscribers do not see these advertisements

I don't think they would know that T&T had told you to self isolate. They aren't interested. They have said they won't allow a claim for a cancelled booking because of T&T contacting you to self isolate. Why would they want to contact T&T? My concern is that people with a holiday booked and no way of getting their money back might be tempted to go anyway.I think their point is not whether or not you have symptoms but whether you have been 'told' by T&T to self-isolate, which I assume they can ascertain from the T&T records.

Although I've understood that the T&T info was confidential.

Claiming to have symptoms would require you to have a test, presumably they might want a copy of a positive test result before paying out.Yes but if you have to cancel a trip, and you can only claim if you say you have symptoms how will they know

I found this in the first section!We rely on our Nationwide account for travel insurance.

If I have understood it correctly, we would be able to claim if we had to cancel a booking because one of us had the disease but not if we have been told to self isolate by track and trace without having symptoms.

I think that is irresponsible of Nationwide, as it encourages people to disregard T&T and travel anyway.

There is no cover for any claim arising directly or indirectly or in any way connected to the disease Covid-19 (coronavirus) or any mutation of it or any disease that is declared a pandemic by the World Health Organisation. This includes any steps taken by any entity including but not limited to transport operator, Government, authority or agency, in response to or as a result of Covid-19 or a pandemic. This also includes any claim for any person being quarantined or self-isolating in relation to Covid-19 or a pandemic.’

- Jun 29, 2015

- 3,842

- 63,716

- Funster No

- 36,999

- MH

- caravan (for now)

- Exp

- on and off since 1984

At the moment best not to book anything in advance, we can't go abroad at the moment due to caring responsibilitys but if we did go away I would only book at the last minute.

Now I am confused. What do the tables refer to.I found this in the first section!

There is no cover for any claim arising directly or indirectly or in any way connected to the disease Covid-19 (coronavirus) or any mutation of it or any disease that is declared a pandemic by the World Health Organisation. This includes any steps taken by any entity including but not limited to transport operator, Government, authority or agency, in response to or as a result of Covid-19 or a pandemic. This also includes any claim for any person being quarantined or self-isolating in relation to Covid-19 or a pandemic.’

I am not planning going anywhere but we do rely on this insurance. It’s free with the account but the account costs money every month so it’s not free really, in fact if the insurance isn’t worth having then the account isn’t either.

I too have the Flexi-account and there are quite a few free benefits associated with this account. Free breakdown cover for your motorhome and car in Europe , free phone cover. The home insurances carries a heavy discount. The travel insurance I.M.O. is second to none as its multitip cover and if you are like me 70+ with a average medical history there is nothing to touch it. Even after I pay the age extension and excess after medical screening that's my wife and I covered for multiple trips in a 12 month period. So, we pay for one 4 month trip to say Greece and the E.U. Say April - August then our next trip, Say Morocco Dec - April is covered too. I have not been able to find any other insurer who cones anywhere near their price.Now I am confused. What do the tables refer to.

I am not planning going anywhere but we do rely on this insurance. It’s free with the account but the account costs money every month so it’s not free really, in fact if the insurance isn’t worth having then the account isn’t either.

I suspect all insurance companies are going to treat Covid 19 in a similar fashion and I wish you the best of luck finding a better deal. If you do perhaps you can post details for the benefit of other members.

Subscribers do not see these advertisements

I think I may have caused some confusion with my post above. That statement is for cancellation of a trip. Cover is still in place before and during your trip with the exception of stated exclusions. Its all there to be read.I found this in the first section!

There is no cover for any claim arising directly or indirectly or in any way connected to the disease Covid-19 (coronavirus) or any mutation of it or any disease that is declared a pandemic by the World Health Organisation. This includes any steps taken by any entity including but not limited to transport operator, Government, authority or agency, in response to or as a result of Covid-19 or a pandemic. This also includes any claim for any person being quarantined or self-isolating in relation to Covid-19 or a pandemic.’

- Dec 24, 2014

- 10,242

- 54,775

- Funster No

- 34,553

- MH

- Compass Navigator

- Exp

- Ever since lighting was by Calor gas.

It seems to me that you are covered (the green coloured bit) for cancelling due to being diagnosed with CV19 but not if (the pink coloured bit) you are cancelling a trip for a reason(s) OTHER THAN a medical one(s).

I must admit their statement does seem confusing.

This what my email from N/W says..

I must admit their statement does seem confusing.

This what my email from N/W says..

Last edited:

Thanks. We will stick with it.I too have the Flexi-account and there are quite a few free benefits associated with this account. Free breakdown cover for your motorhome and car in Europe , free phone cover. The home insurances carries a heavy discount. The travel insurance I.M.O. is second to none as its multitip cover and if you are like me 70+ with a average medical history there is nothing to touch it. Even after I pay the age extension and excess after medical screening that's my wife and I covered for multiple trips in a 12 month period. So, we pay for one 4 month trip to say Greece and the E.U. Say April - August then our next trip, Say Morocco Dec - April is covered too. I have not been able to find any other insurer who cones anywhere near their price.

I suspect all insurance companies are going to treat Covid 19 in a similar fashion and I wish you the best of luck finding a better deal. If you do perhaps you can post details for the benefit of other members.

It doesn't surprise me that insurance companies are trying to limit their liability. There must have been a load of cancellation claims at the start and anyone booking now must realise theres a risk of cancellation/restrictions etc only seems fair that if you want to take a punt you carry the risk.

Subscribers do not see these advertisements

- Nov 22, 2018

- 1,959

- 19,256

- Funster No

- 57,328

- MH

- Rimor Europeo 87

- Exp

- Five years plus three tugging

We use Nationwide for hols insurance. This is disappointing but not unexpected. I read it to say that if you have something booked, and the FCDO change their advice, then you lose whatever you have paid.

I suspect that those moho sites that don't require a deposit or fully paid upfront are gong to be popular next year.

I suspect that those moho sites that don't require a deposit or fully paid upfront are gong to be popular next year.

I suspect the vast majority will not require a non refundable advance deposit or up front payment and I bit like this year, very few going abroad and then the flood gates will open and it will be a free for all.We use Nationwide for hols insurance. This is disappointing but not unexpected. I read it to say that if you have something booked, and the FCDO change their advice, then you lose whatever you have paid.

I suspect that those moho sites that don't require a deposit or fully paid upfront are gong to be popular next year.

I think if there was a non refundable 20%deposit it wouldn't put me off at all it's just sharing some of the risk with them after all theyre going to lose a lot more and will still be doing a fair bit of maintenance even if they're told at the last minute they can't open.We use Nationwide for hols insurance. This is disappointing but not unexpected. I read it to say that if you have something booked, and the FCDO change their advice, then you lose whatever you have paid.

I suspect that those moho sites that don't require a deposit or fully paid upfront are gong to be popular next year.

- Nov 22, 2018

- 1,959

- 19,256

- Funster No

- 57,328

- MH

- Rimor Europeo 87

- Exp

- Five years plus three tugging

Yep, me too.I think if there was a non refundable 20%deposit it wouldn't put me off at all it's just sharing some of the risk with them after all theyre going to lose a lot more and will still be doing a fair bit of maintenance even if they're told at the last minute they can't open.

We use sites in Yerp that are so booked up in advance by our Westphalian and Saxon neighbours, that you have to book early. If their govt close them down, they lose the lot.