R

Robert Clark

Deleted User

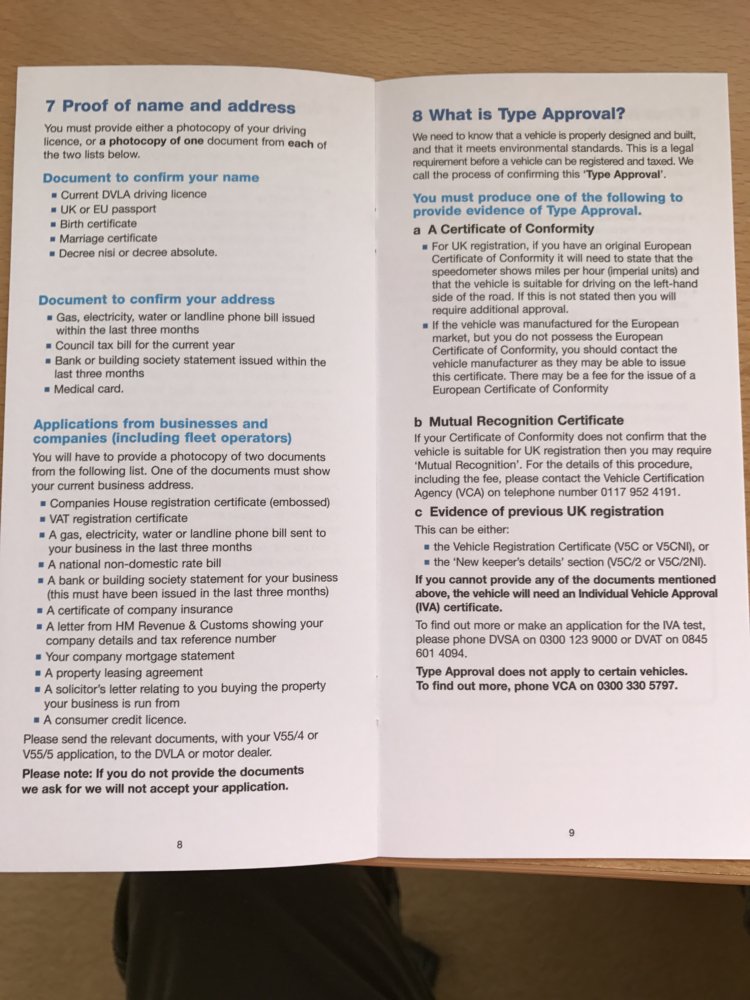

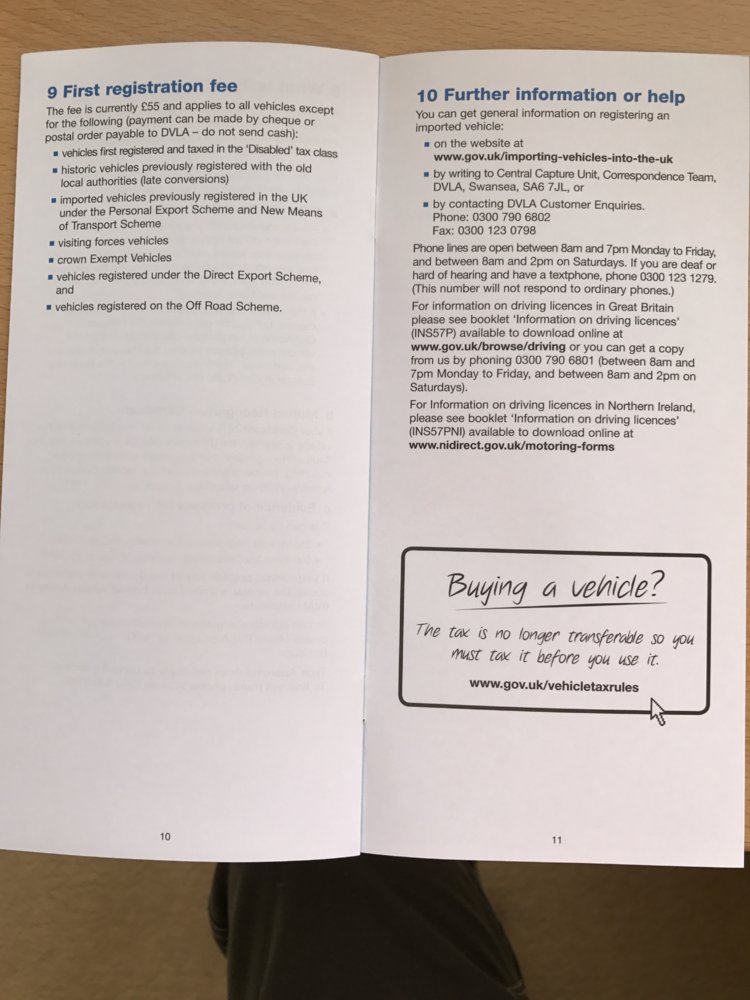

Just received this in the post

May be useful to others

May be useful to others

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

Subscribers do not see these advertisements

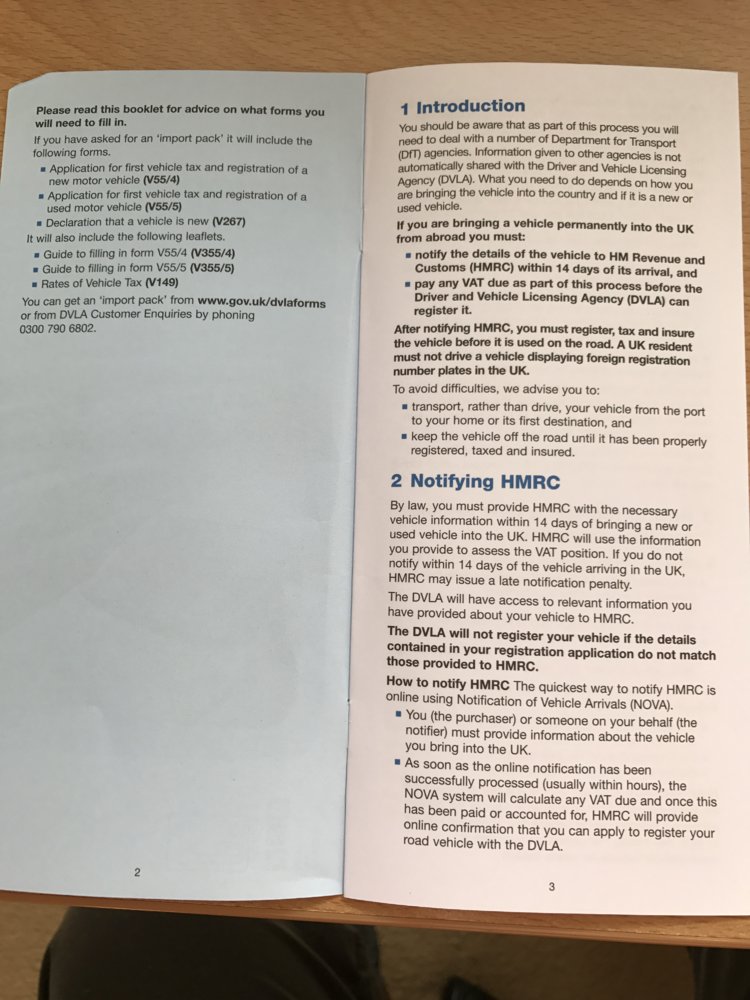

I understand that you have to pay vat when importing a vehicle into the UK from the EUDuty and VAT not applicable within the EU . Should we leave without a trade agreement it will then apply . Importing from the rest of the world it does apply.

My understanding to (assuming new).This section is a bit onerous

I understand that you have to pay vat when importing a vehicle into the UK from the EU

Subscribers do not see these advertisements

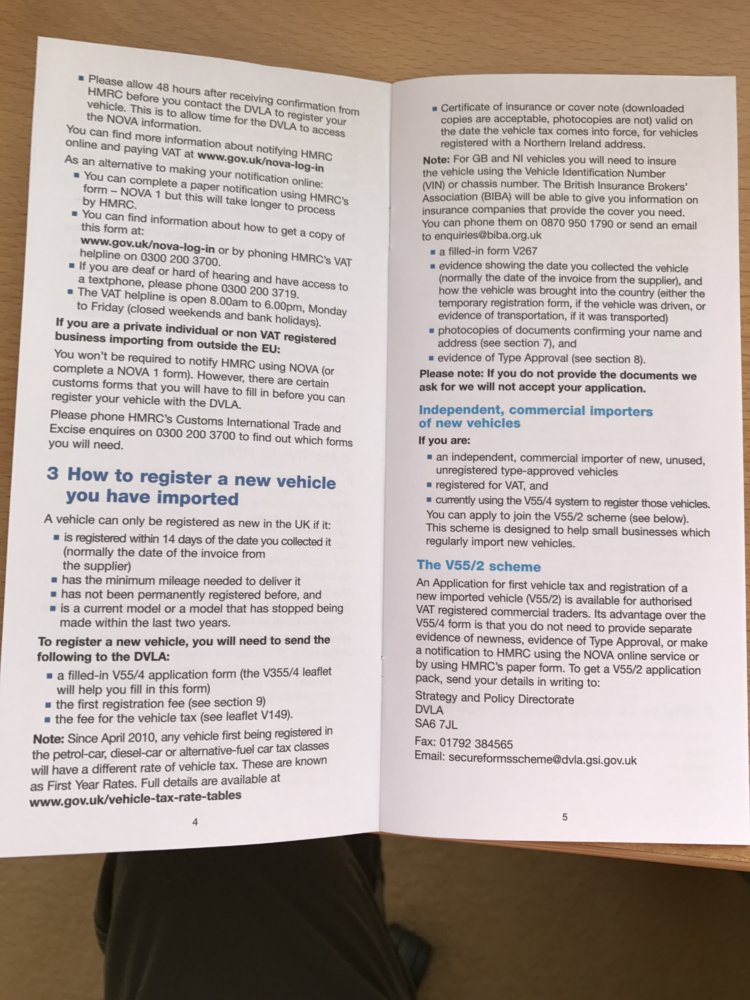

if you import a new van, you pay UK VAT - but no duty....

if you have paid VAT in say germany, you still need to pay UK VAT and reclaim German VAT if i understand correctly - new vehicles are subject to different VAT arrangements than regular goods bought in the EU and imported.

It is reasonably straightforward tho - you use the NOVA process

https://www.gov.uk/importing-vehicles-into-the-uk/telling-hmrc

https://www.gov.uk/nova-log-in

Subscribers do not see these advertisements

One has to question how many times you have privately imported a new vehicle. The dealers WILL be required to account for the sales tax and if they do not have proof that it was exported and the sales tax paid in the other EU country then they will have to pay in theirs and be out of pocket. The process you define only applies from one VAT registered entity to another quoting the importers VAT number which under the new legislation will be a import export approved number not your bog standard UK VAT number.If buying from a dealer in the EU , get them to supply VAT free for export, then you pay HMRC the VAT in the UK. All cross border transactions are handled in this way. You may be asked to sign a form confirming that the goods have been exported from the supplying country.

Subscribers do not see these advertisements

Subscribers do not see these advertisements